5 Things to Include in an Invoice Template For Cleaning Services

This post is also available in:

![]()

![]()

![]()

![]()

Cleaning can be very fulfilling, but it’s also hard work. So, if you provide cleaning services, it’s important that you and your workers are paid for your time and effort.

Invoicing and ensuring payment can be a sore point for cleaning businesses, especially smaller domestic cleaning businesses. It’s too easy for private clients to forget to pay the cleaner in the rush of their daily lives. This means that the cleaner has to chase the client for the money they’re owed, which nobody enjoys having to do!

An easy way to streamline this process is using an Excel Invoice Template or invoice generator to make the payment issue a lot easier, regardless of your concerns. As well as looking professional, it clarifies things like amounts, services rendered, payment due dates, and more so that there’s no confusion.

As well as ensuring you get paid on time, invoices eliminate cleaner/client confusion, which is essential for maintaining healthy and long-lasting client relationships.

Creating an invoice is not difficult once you know what to include. So, here are the five key things you need to create an excellent invoice template.

5 key components of a cleaning service invoice

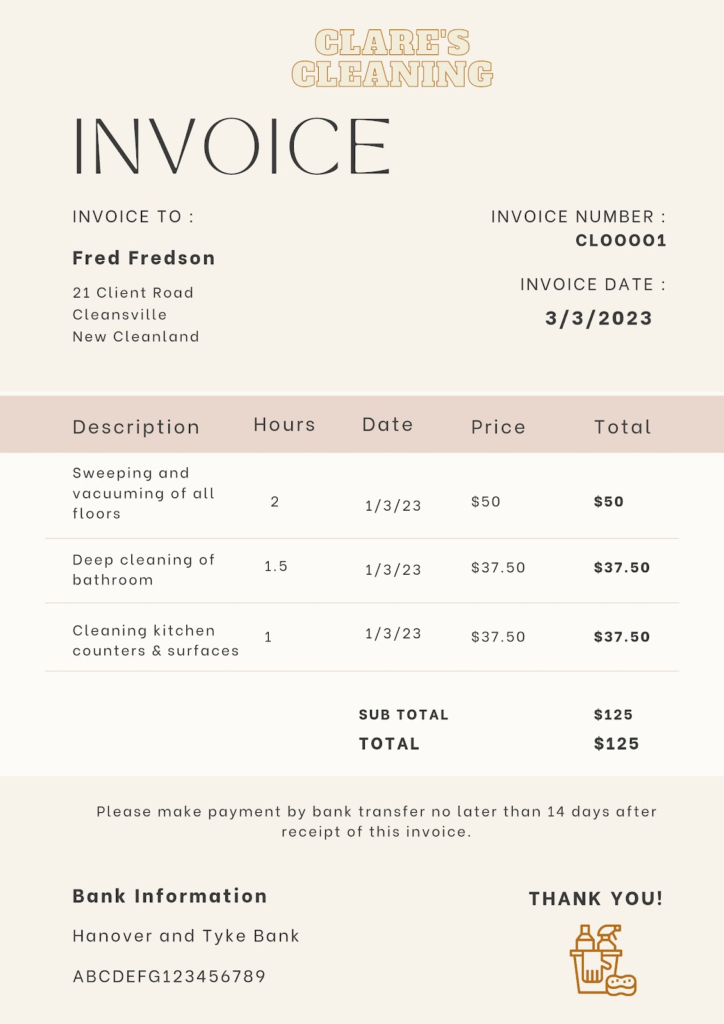

Here is a mockup of an invoice supplied by a fictional cleaning company. Let’s break down its essential elements:

1. Company and client information

First up, we have the company and client information. The invoice recipient can easily see that Clare’s Cleaning has issued the invoice and that it is intended for Fred Fredson.

Here, the company has only provided the client’s address on the invoice itself, but you may want to provide your business address as well for extra clarity.

2. Invoice date and number

Next to the client information, you can see a unique invoice number and the date the invoice was issued.

A unique invoice number is important for your and your client’s records. If you clean for commercial businesses, they will need you to provide an invoice number for their tax purposes.

The date of issue is important for two major reasons.

- Firstly, it helps to ensure that you get paid on time. While Clare’s Cleaning company (like many companies) asks for payment no later than fourteen days after the client receives the invoice, a date of issue can substantially strengthen your case for prompt payment if a client is a habitually late payer.

- Secondly, it helps you and your clients to organize your invoices for their records.

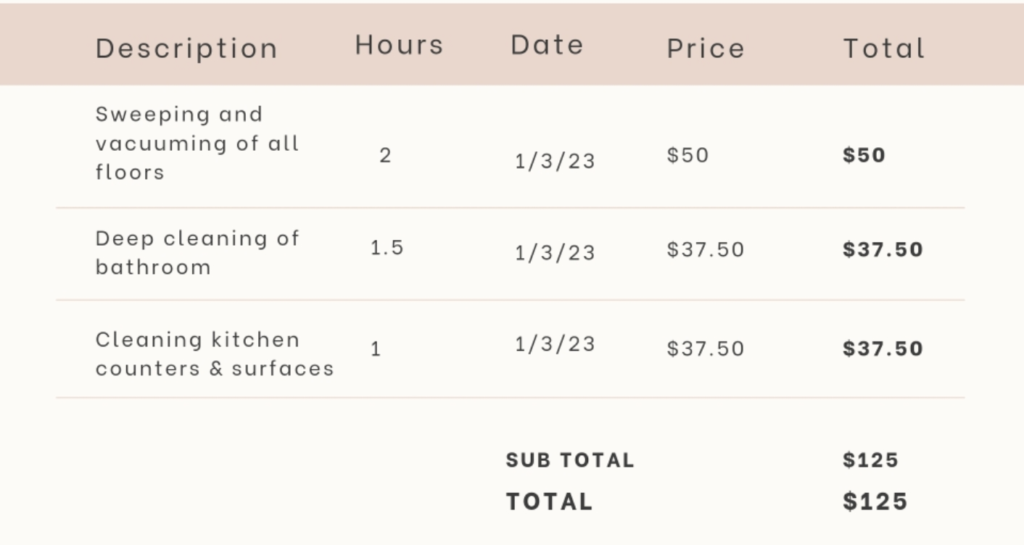

3. List of services rendered

The body of your invoice should detail what the client is paying for. How you show this depends a lot on how you charge. For example, if you charge by the hour rather than at a set rate per task, you could set down the number of hours worked and the date on which the work occurred.

As you can see, Clare from Clare’s Cleaning likes to be thorough. She charges by the hour but also breaks her invoices down by task. The client can clearly see what has been done, how long it took, the date the work happened, and how much they are being charged for it.

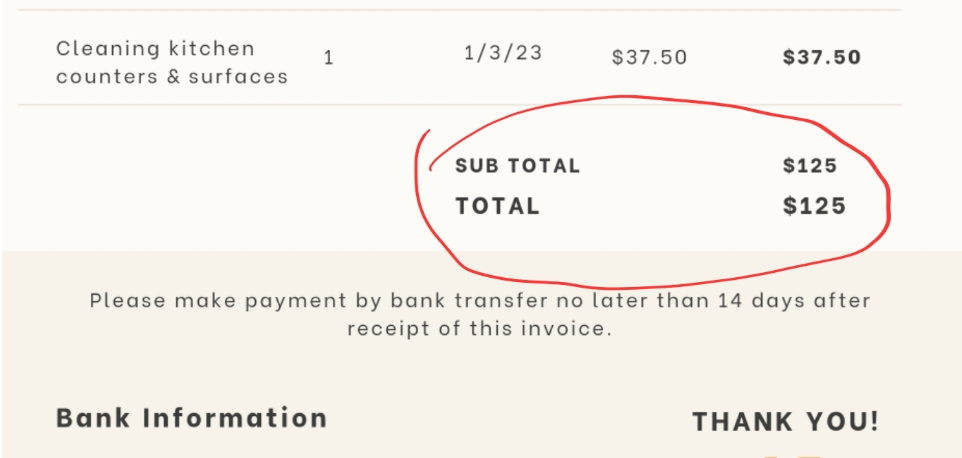

4. Total amount due

It’s crucial that your client can see at a glance how much they owe you. Make things easy for them by totting up the total and clearly marking it on your invoice. As you can see here, Clare of Clare’s Cleaning has increased the font size for the total amount payable, making it very easy for the client to see.

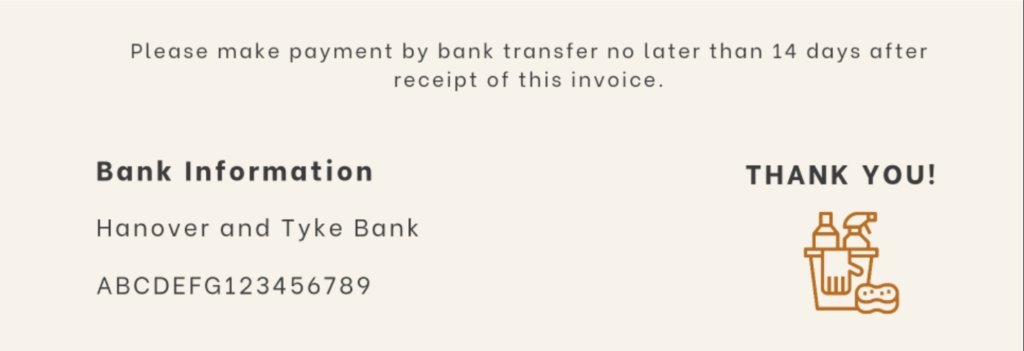

5. Terms and methods of payment

The final part of Clare’s invoice is dedicated to payment. Clare clearly specifies that payment should be made no later than 14 days after the client receives the invoice and that they should pay by bank transfer. She also provides the account details for payment.

If you are uncomfortable with putting bank details on an invoice, there are plenty of other options. For example, you could request payment through a secure third-party provider like PayPal or Venmo. Or you could use an online booking system or invoicing software.

Best practices for creating an effective invoice template for cleaning services

Provide a clear and concise description of services rendered

Clarity is everything when it comes to invoices. You want to make your invoice as easy as possible to understand. If your client has to ask questions about what they’re paying for, it could delay payment and even cause controversy between you and your client.

Make sure that your descriptions of services rendered aren’t hard to understand. For example, rather than using jargon like “Sanitation of food preparation areas,” say “Cleaning kitchen.” If you need to go into more detail, you can include exactly what you did and the materials you used in a breakdown of costs.

Include a breakdown of costs

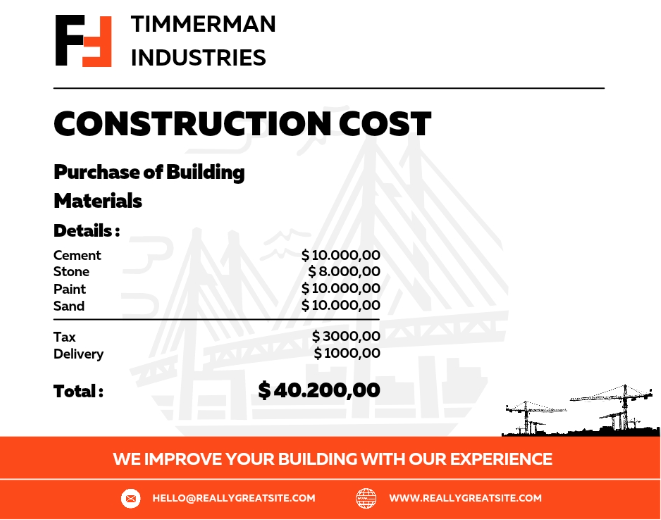

It isn’t always easy to break down costs for cleaning. In an industry like construction, it is more straightforward to detail the materials used and how these contribute to the cost of the whole operation. Here, for example, is a mockup of a cost breakdown from a fictional construction company:

How you detail your costs with a cleaning company depends significantly on your business model and mode of operation.

For example, if you run a small domestic cleaning company and use your client’s cleaning supplies, your main costs will be your time and travel expenses. Factoring these into an invoice may be a little too granular, so many cleaners ensure that their hourly rate can cover travel expenses.

However, if you are using large amounts of supplies you have brought in yourself, it may be worth detailing these separately in a cost document.

You can also include any tax charged in your breakdown. In the USA, sales tax is not usually applicable for cleaning services as you’re providing a service rather than a product. But this depends on your state, so do your research to determine whether you should charge it.

If you’re UK based, you’ll need to charge VAT. Including this on your invoice will show your customer the tax paid and help your record keeping. To manage the VAT you collect, you can use VAT software to keep a digital record, calculate VAT, and help you submit your tax returns.

If you intend to charge clients directly for materials used, be sure to keep your receipts for the client’s records. You may need to charge sales tax on these products if you’re US-based. Look into this if you plan on supplying your clients with cleaning materials.

Use an invoice management system

A good invoice management system is a game changer. Rather than having to struggle with complex paperwork, it forms part of your online accounting solution and can:

- Track invoices and accounts payable.

- Flag up late payments.

- Prevent double-handling.

- Store invoices and account details securely.

- Notify when it is time to issue an invoice.

- Process data accurately and quickly.

- Give insights into things like costs and profits.

- Archive invoices in an organized and easily accessible way.

- Integrate processing and payment into a single platform.

If you are working with big commercial companies, adding tax software to your invoice management system may be worth your while. This will calculate the sales tax or VAT on your cost breakdown and automatically add it to your invoices, saving you a lot of time. This will calculate the VAT or sales tax on your cost breakdown and automatically add it to your invoices, saving you a lot of time. Additionally, using CRM can help you store all the customer invoices, strengthening your invoicing and financial game.

State payment due dates and acceptable payment methods clearly

Your invoice must leave absolutely no room for confusion. Make sure your client knows exactly how much they owe, how they should pay it, and when you expect the money to be paid.

In our earlier example, Clare of Clare’s Cleaning requests to be paid by bank transfer within fourteen days of the client receiving the invoice. This is pretty standard procedure, but it’s far from the only option available.

For example, some invoice management platforms offer an integrated payment method. You could use your invoice to direct clients to a payment processing page on your website or even add payments to your online booking system. Whatever works best for you!

Most importantly, clients can clearly see how and when to pay.

Provide company contact information

Clients may want to contact you to clarify things about your invoice—or, hopefully, to book you for more work! So, make sure that you clearly provide your contact information.

If there is no room on the invoice itself for your contact information, add it on the reverse or a separate page. Many companies may also send invoices through an invoice management system, which will embed company contact details within the email that sends the invoice.

A good invoice is critical to timely payments

Everyone deserves to be paid promptly for their hard work. A good invoicing and payment system is key to this.

With the right invoice template, you can ensure that your clients know exactly what they’re paying for, what payment channel they should use, and when the payment is due.

Good invoices also help you with your records, especially when combined with an excellent invoice management system.

So, what are you waiting for? Time to get organized and get invoicing!

Comments

0 commentsNo comments yet